The 8-Second Trick For Retirement Income Planning

Table of ContentsGet This Report on Retirement Income PlanningWhat Does Retirement Income Planning Mean?What Does Retirement Income Planning Mean?Some Known Questions About Retirement Income Planning.Get This Report on Retirement Income PlanningRetirement Income Planning Things To Know Before You Buy

There are a number of concerns that need to be answered when you're intending retirement income. 1) Figuring out when to retire is a key element in preparing your retirement income. While this inquiry may not be very easy, it's essential to consider all of the numerous variables to offer you the possibility of the best retirement possible.Duration Particular This alternative permits you to receive a payment for an established number of years. Also if you pass away before the complete duration of time, your beneficiaries will remain to get the annuity. Swelling Sum This option enables you to select an one-time cash settlement currently, for no more settlements.

4) When intending your retired life revenue, it's crucial to take taxes right into factor to consider. Inevitably, there are 3 different tax obligation treatments in retirement.

Rumored Buzz on Retirement Income Planning

Your tax-deferred accounts are accounts where you didn't pay tax obligation on your payment or seed money. Instead, when you draw cash out of these accounts, your withdrawals will certainly be strained as ordinary earnings.

With a tax-free account, the taxes were paid on the contribution, so development as well as withdrawals are not tired, as long as you comply with internal revenue service regulations. Examples of tax-free accounts are municipal bonds, Roth IRAs, as well as particular types of cash money value insurance policy - retirement income planning. With a clear income plan that takes tax obligations into account, it might be feasible to proactively decrease your tax obligation expense during retirement.

The smart Trick of Retirement Income Planning That Nobody is Discussing

This is money you're depending upon accessing in the short-term. retirement income planning. You'll desire to safeguard this money from market volatility and choose very conventional financial instruments. This pail holds cash you will not need to access for 4-6 years. It holds traditional investments that will restore the short-term container when worn down.

For some Americans, a viable technique is to downsize their house by selling it, and also after that utilize a section of the gains to fund retirement. Uncle Sam has made this method work from a tax viewpoint.

Regardless of why you function, the extra earnings you create will certainly also be consisted of in your plan as it can decrease the amount of properties needed to draw down for capital.

The Best Guide To Retirement Income Planning

This is a fundamental resource of income for the majority of people. When you make a decision to take it may have a big influence on your retirement. It can be alluring to assert your benefit as quickly as you're qualified for Social Securitytypically at age 62. That can be a pricey action.

(FRA ranges from 66 to 67, depending on the year in which you were born.) Figure out your complete retired life age, and also job with your financial expert to check out how the timing of your Social Safety advantage fits into your overall strategy. Pensions made use of to be prevalent, they aren't so much anymore.

1 If you're one of those individuals, you'll wish to weigh the advantages and disadvantages of exactly how you take out the moneyas a round figure or stream of earnings. If you do not have a pension, there are other ways to produce a pension-like stream of income.: A fixed income annuity is an agreement handled by an insurance policy company that, in return for an in advance investment, assurances * to pay you (or you and also your partner) a set quantity of income either for the remainder of your life (as well as the life of an enduring partner in the situation of a joint and also survivor annuity) for a collection period of time.

Some Known Questions About Retirement Income Planning.

Furthermore, there are choices to provide a benefit to your heirs, if that is an option that is essential to you. While each kind of annuity can provide an eye-catching blend of functions, work with your economic professional to aid figure out which annuity or a combination of annuities is appropriate for you in developing a diversified earnings plan.

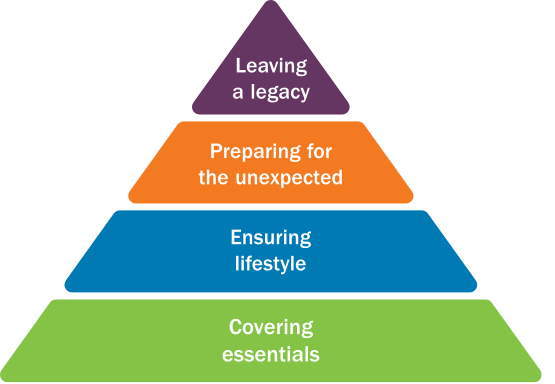

You'll want to consider exactly how you can spend for those enjoyable things you've constantly dreamed about doing when you ultimately have the timethings like holidays, leisure activities, Get More Info and also other nice-to-haves. It's a wise approach to pay for these sort of expenditures from your investments. That's because if the marketplace were to choke up, you might constantly reduce on some of these costs.

Everybody's situation is one-of-a-kind, so there's no one revenue strategy that will benefit read more all capitalists. You'll need to determine the relative importance of development capacity, assurances, or versatility to help you pinpoint the method that is ideal for you in retirement. Of course, there are tradeoffs. For example, even more growth possibility can suggest choosing much less guaranteed earnings.

See This Report on Retirement Income Planning

Retirement preparation considers not only assets as well as revenue but also future costs, responsibilities, and life expectancy. If you are under 50, you can contribute an optimum of $20,500 in 2022 to a $401(k). In the simplest feeling, retired visit this web-site life planning is what one does to be gotten ready for life after paid work ends.